Irish Pensions Magazine Autumn 2016

8

Advertorial

Expert Opinion

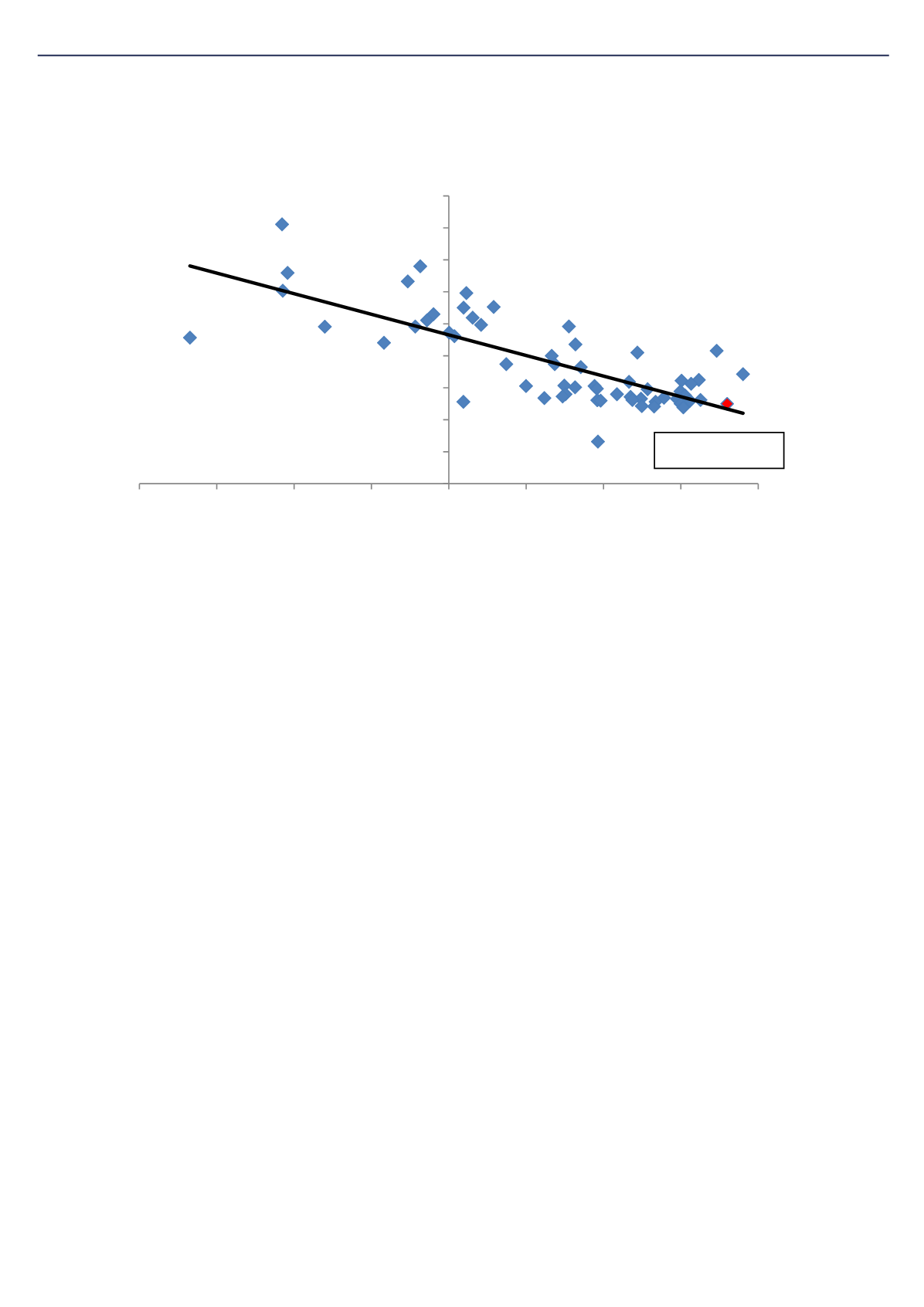

Figure 3: Funds beta relative to historical returns

Source:Morningstar data for HardCurrency for three years to30 June 2016.

Past performance is not a guarantee of future results.

Broad index exposure appears to provide some

defence for investors from some of the inherent

behavioural biases of active managers and provides

higher return potential, even though it means being

exposed to both stronger and weaker parts of the

market.

Portfolio Construction: Understanding the

Underlying Exposure

It is not ground-breaking to state that diversification

is considered a positive for investment portfolios. But

it is worth looking at how active managers approach

portfolio construction. In local currency, active funds

have generally invested in more countries than are in

the JPM GBI-EM Global Diversified Index. At the same

time though, active funds tend to hold significantly

fewer securities than the benchmark; at the end of

2015, this index contained 188 bonds across 15

countries, while the average number of holdings in

an active fund stood at 89 across 22 countries.

Managing concentrated portfolios in such an

idiosyncratic market runs the risk of significantly

higher tracking error, while also requiring trading in

larger tickets. This may lead to higher trading costs

and contribute to the underperformance of active

strategies.

Index Strategies Provide Cost-Effective

Solutions

Sowhile it is clear that active strategies face headwinds

in EMD investing, there were also perceived

challenges to adopting index strategies in the EMD

space. However, experienced index managers have

taken practical steps to minimise the negative

effects of historically high replication costs, volatility

and considerable inefficiency in the EMD space. At

State Street Global Advisors, we have been running

indexed EMD strategies for over 10 years and this

investment expertise is evident in our consistent and

efficient delivery of benchmark returns in indexed

EMD strategies and funds.

While the trading cost for EM hard currency bonds

is similar to investment grade corporate bonds, the

cost of trading local currency denominated securities

is half that. The cost of replication is thus no longer

as prohibitive as many might think. When you marry

this with an experienced, dedicated and co-located

EM trading desk, portfolio managers (PMs) are able

to keep trading costs down.

EMD indices typically experience higher levels of

turnover than other fixed income benchmarks with

consequent rebalancing costs. Experienced PMs can

minimise turnover by pro-actively anticipating index

changes, gaining exposure through primary market

placements and working with their traders to access

liquidity pools.

While certain taxes are difficult to avoid when

holding local EM bonds, a sophisticated investment

management process that understands the risk/

reward trade-offs between fully replicating the

benchmark and alternative positions or proxies can

minimise the tax drag without compromising on

acceptable levels of risk.

Finally, indexed EMD strategies are not passive when

it comes to portfolio construction and security

0.50

0.70

0.90

1.10

1.30

1.50

1.70

1.90

2.10

2.30

-8.00 -6.00 -4.00 -2.00 0.00

2.00

4.00

6.00

8.00

Beta

Total Return, %

JPM EMBIG DIV