7

Irish Pensions Magazine Autumn 2016

Expert Opinion

Advertorial

What is particularly fascinating about this is the fact

that underperformance cannot be blamed on a single

bad year or a one-off ‘Black Swan’ event.

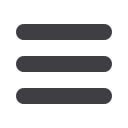

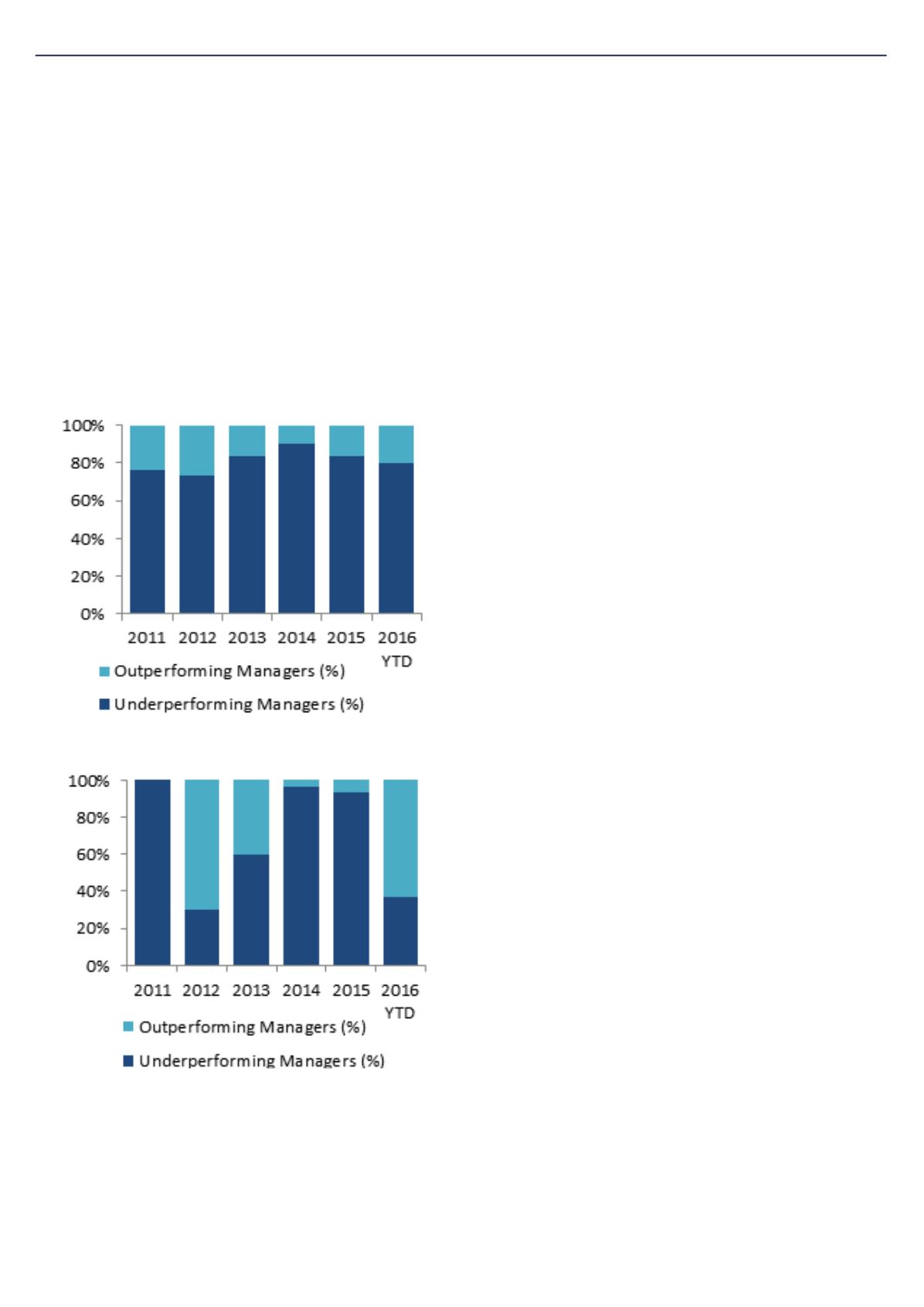

In the local currency segment, the percentage of

outperformers is consistently about 20–25%. In the

hard currency space, there are some sporadic hits (as

in particularly good years like 2012 and H1 2016), but

more often there are significant misses that lead to

active managers underperforming over the medium

and long term.

Figure 2: Active funds’ annual performance

relative to benchmark

Local Currency EM Debt

Hard Currency EM Debt

Source: Morningstar as at 30 June 2016.

Past performance is not a guarantee of future results.

Ultimately, the inherently ‘high-octane’ and

volatile nature of the EMD sector drives active

underperformance. Investor sentiment often drives

returns and may be misaligned with fundamental

valuations; unpredicatable geopolitical factors also

play a part.

Diversification as a Bulwark

Unpredictability could be a byword for EM investing,

given that sell-offs are so often event and sentiment

driven. But it has been shown again and again that

diversification helps mitigate against potential credit

events and a credit risk premium can be harvested

across the overall portfolio to compensate for such

events.

Our study of active managers’ biases reveals that the

vast majority of funds take a higher beta exposure

relative to the underlying market, presumably with

the intention of earning carry and benefiting from

any market rally. Looking at the hard currency

universe, the average beta of active funds stands

at around 1.25 – meaning one can expect them to

outperform ‘up’ markets by about 25%. Only 7%

of the active fund universe has a beta that is lower

than the market, despite the prevailing view earlier

in 2016 that emerging markets and China could face

a challenging time. In the five-year period to June

2016, funds with a beta of 1 or lower significantly

outperformed strategies with higher-than-market

betas (average returns of 4.65% vs 2.66%). This is

part of the reason why active managers performed

so strongly during the hard currency EM bull market

of 2012 and the first half of this year. Another reason

is likely to be that there were no major individual

country ‘blow-ups’ during those periods.

23rd February

The Double Tree Hotel

Burlington Road, Dublin