Irish Pensions Magazine Autumn 2016

6

Advertorial

Expert Opinion

P

ension investors are well aware that the pool of

fixed income assets yielding decent income levels

has been greatly diminished and they have been

casting around for alternative options. And yet,

for one reason or another, many investors seem

unconvinced of the merits of an asset class that has

developed rapidly in recent years: Emerging Markets

Debt (EMD). Investor attitude towards EMD still

appears focused on perceptions and assumptions

that are too often rooted in the past.

However, a quick scan of developments serves to

highlight the advances made in EMD:

• EMD has become a large, diverse and relatively

liquid universe.

• The market is now about US$4 trillion

1

, with a

mix of local and hard currency issues and a well-

developed corporate market.

• The increasing breadth and depth of the market

has enhanced liquidity.

At the same time, one can understand the reticence

to fully embrace EMD. Inefficiencies and volatility

remain high and, while those are market factors that

active investors traditionally look to exploit, they

may actually be too high for active managers to

consistently deliver excess returns. We believe that

intelligent indexed approaches to EMD that aim to

capture this complex market exposure in a consistent

and cost effective manner deserve consideration. In

fact, such strategies have been gaining market share.

Understanding Why Active Managers Have

Struggled

Sowhy isn’t the activemanagement approachworking

in EMD? After all, the perceived inefficiencies and the

diverse nature of the market, together with the belief

that detailed fundamental knowledge provides an

advantage should enable active managers to identify

and extract value. But looking at the Morningstar

database, we can see that the 30 largest active funds

tracking two flagship indices (JPM GBI-EM Global

Diversified Index for local currency and JPM EMBI

Global Diversified for hard currency) have significantly

underperformed their respective benchmarks (Figure

1).

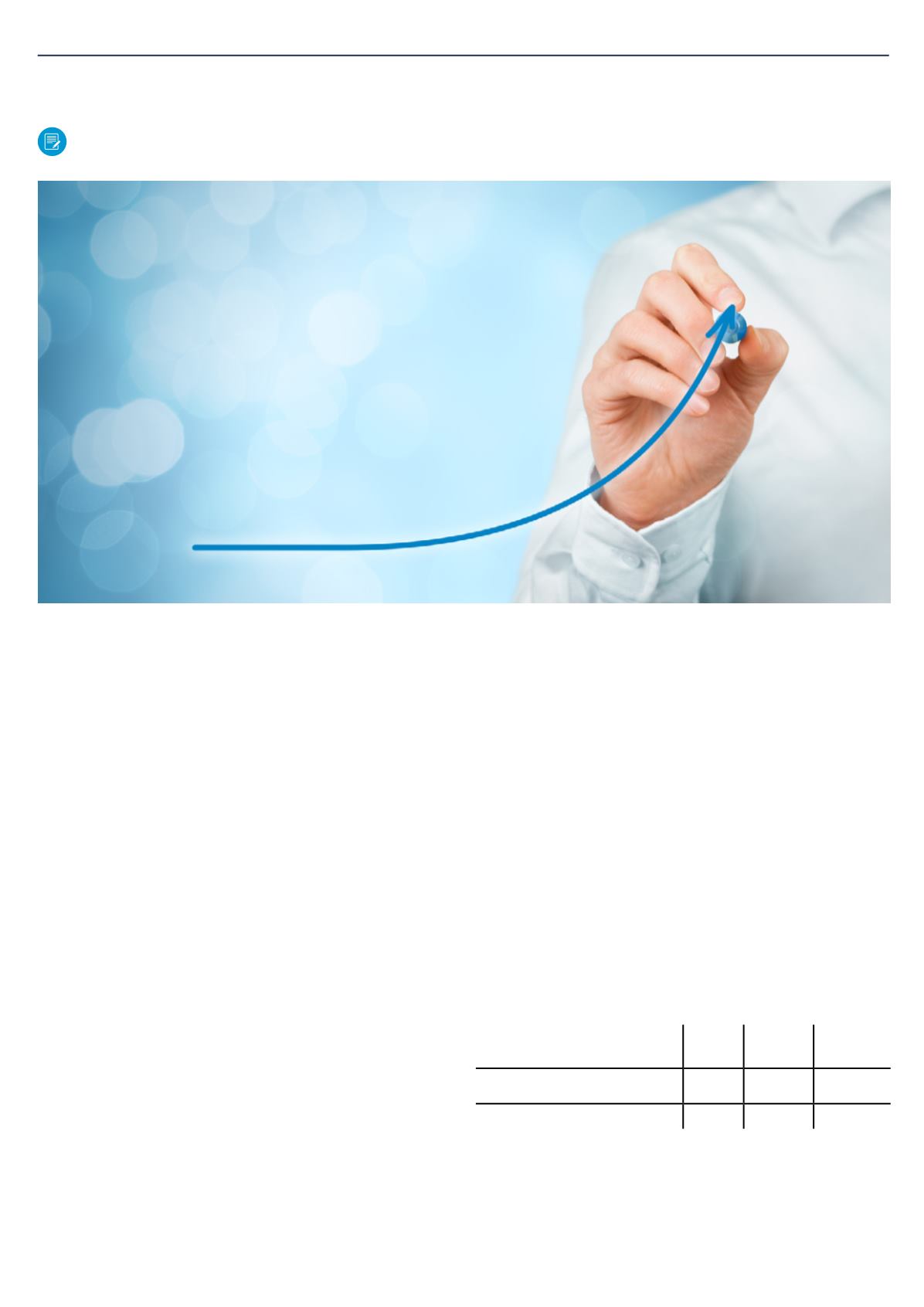

Figure 1: Historical Performance of Active

Managers

Percent of Underperforming Active Managers

1 Year

(%)

3 Years

(%)

5 Years

(%)

Hard Currency Universe

87 97

97

Local Currency Universe

90 93

93

Source: Morningstar as at 30 June 2016. The universe of active

managers is generated by selecting the largest 30 live funds with

the primary prospectus benchmark of JPM EMBI Global Diversified

Index for the hard currency analysis and JPM GBI-EM Global

Diversified Index for the local currency analysis.

Past performance is not a guarantee of future results.

Emerging Market Debt: Passive Management on the Rise

by Niall O’Leary