19

Irish Pensions Magazine Autumn 2013

Expert Opinions

Offsetting materialises when investment ideas are

negatively correlated. The ideas could then offset

each other leading to a loss of effectiveness and little

benefit from high conviction trades.

Drawdown tools

The easiest way to manage drawdown reduce the

probability of it happening. The first step to avoid

drawdown is to make the diversification of the portfolio

as effective as possible. Then sizing the position

appropriately as illustrated in the previous section

should dilute the effect of unsuccessful investment

ideas. It should prepare the ground for an additional

layer of protection through drawdown management.

As an investment idea is formulated, drawdown levels

are set. These levels should determine the maximum

loss that can incur in a portfolio from the investment

idea. For a highly liquid instrument, the drawdown

strategy should mimic being protected by an option

but without having to pay the premium. This leads to

an absolute return mind-set on the investment idea.

Highly diversified investment ideas with appropriate

levels of risk are still the best way to ensure that

one poorly performing investment strategy will not

adversely affect overall performance.

Drawdown management helps protect the fund from a

single poorly performing investment idea. However, it

won’t protect against multiple unsuccessful investment

ideas. This can happen either due to the low success

ratio of the investment ideas, or due to an undesired

correlation between the positions. In both cases,

monitoring tools on groups of investment ideas using

ex-ante and ex-post measures should be done in a

Page 1 I Dublin, June 2013 Pioneer Investment Conference

For Professional Clients acting in an Intermediary Capacity or For Own Account Use Only

and Not to be Distributed to the Public

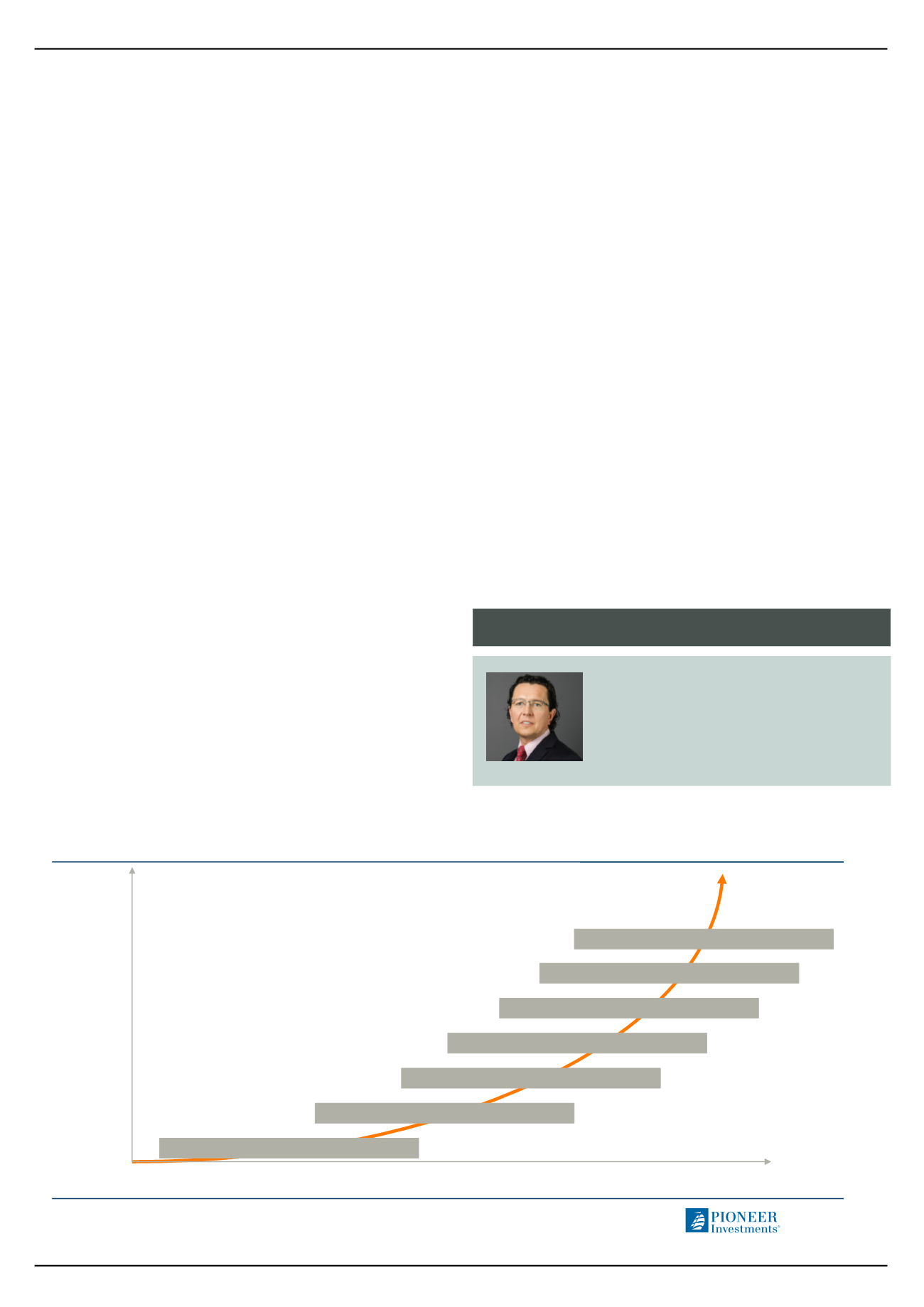

Portfolio Construction and Risk Budgeting

An Integrated Model

Risk Measurement

Strategies Definitions

Risk Budgets Planning and Review

Delegated Strategies Management

Strategies Composition Optimisation

Efficient Drawdown Management

…

SERVICE PROVIDER

PARTNER

RISK

RISK-ADJUSTED

PERFORMANCE

systematic way. This helps identify, at an early stage,

deviations from expected drawdowns that then allow

prompt corrective actions.

The risk budgeting system has been one of Pioneer

Investments most important developments in recent

years. Combining specialised investment skills with

a strong risk management discipline allows active

managers to better exploit market opportunities,

while at the same time paying significant attention to

drawdown management – making all the difference for

clients.

Unless otherwise stated all information and views expressed

are those of Pioneer Investments as at 13th August 2013

These views are subject to change at any time based on

market and other conditions and there can be no assurances

that countries, markets or sectors will perform as expected.

Investments involve certain risks, including political and

currency risks. Investment return and principal value may

go down as well as up and could result in the loss of all

capital invested.

Pioneer Investments is a trading name of the Pioneer Global

Asset Management S.p.A. group of companies.

Article Author

Dave Santry

Head of Irish Institional Business

Pioneer Investments