Irish Pensions Magazine Autumn 2013

12

members also introduces further uncertainty about

future government policy. The recent announcement

of a continued pension levy (and a “double levy” in

2014) is likely to further this impact.

Sovereign Annuities

Sovereign annuities have been available in the

marketplace since the start of 2013. Irish Life have

led the way in bringing this new product to the market.

Indeed Irish Life closed the first sovereign annuity

deal which concluded earlier this year. The transaction

process is now fully bedded in and there is a seamless

process in place to move through to deal execution.

There are three active providers offering sovereign

annuities in the marketplace. All providers link their

sovereign annuity product to Irish Sovereign debt –

by using special bonds called Irish Amortising Bonds

issued by the NTMA. These bonds trade at a spread

to AAA bonds and as a result sovereign annuities are

available at a discount to conventional annuities. The

current discount range is 10% - 12% (the discount

varies from scheme to scheme).

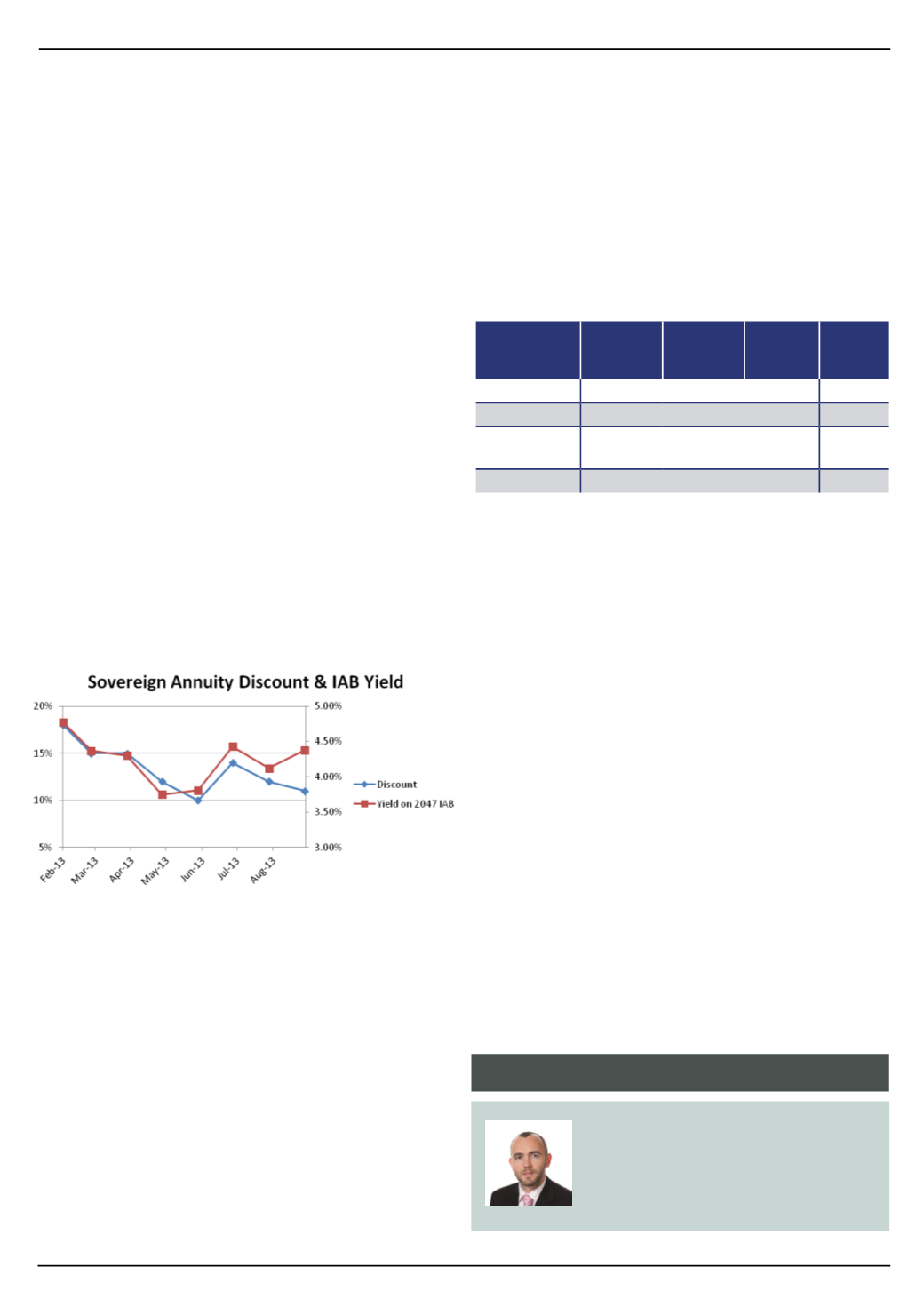

The chart below details the movement in the average

sovereign annuity discount (where the discount is

to conventional annuity terms) and the yield on Irish

Amortising Bonds (IABs) over 2013.

This discount means that sovereign annuities are a key

tool in restructuring troubled defined benefit schemes.

They have accounted for approximately 75% of the

bulk annuity business placed in the market so far this

year. They have generally been used in two different

ways:

• Purchased as part of the wind-up of an underfunded

scheme to increase the level of coverage for active

and deferred members.

• Purchased as part of a scheme restructuring

exercise, in conjunction with agreeing a long term

funding plan (and often tied in with a Section 50

application).

The initial sovereign annuity transactions included

some level of a conventional annuity under-pin (referred

to here as a mixed product). For example, where the

first €5,000 of annual pension is secured by means

of a conventional annuity with the balance above

this being secured by means of a sovereign annuity.

However most of the latest transactions completed in

the marketplace have been a full sovereign annuity

basis.

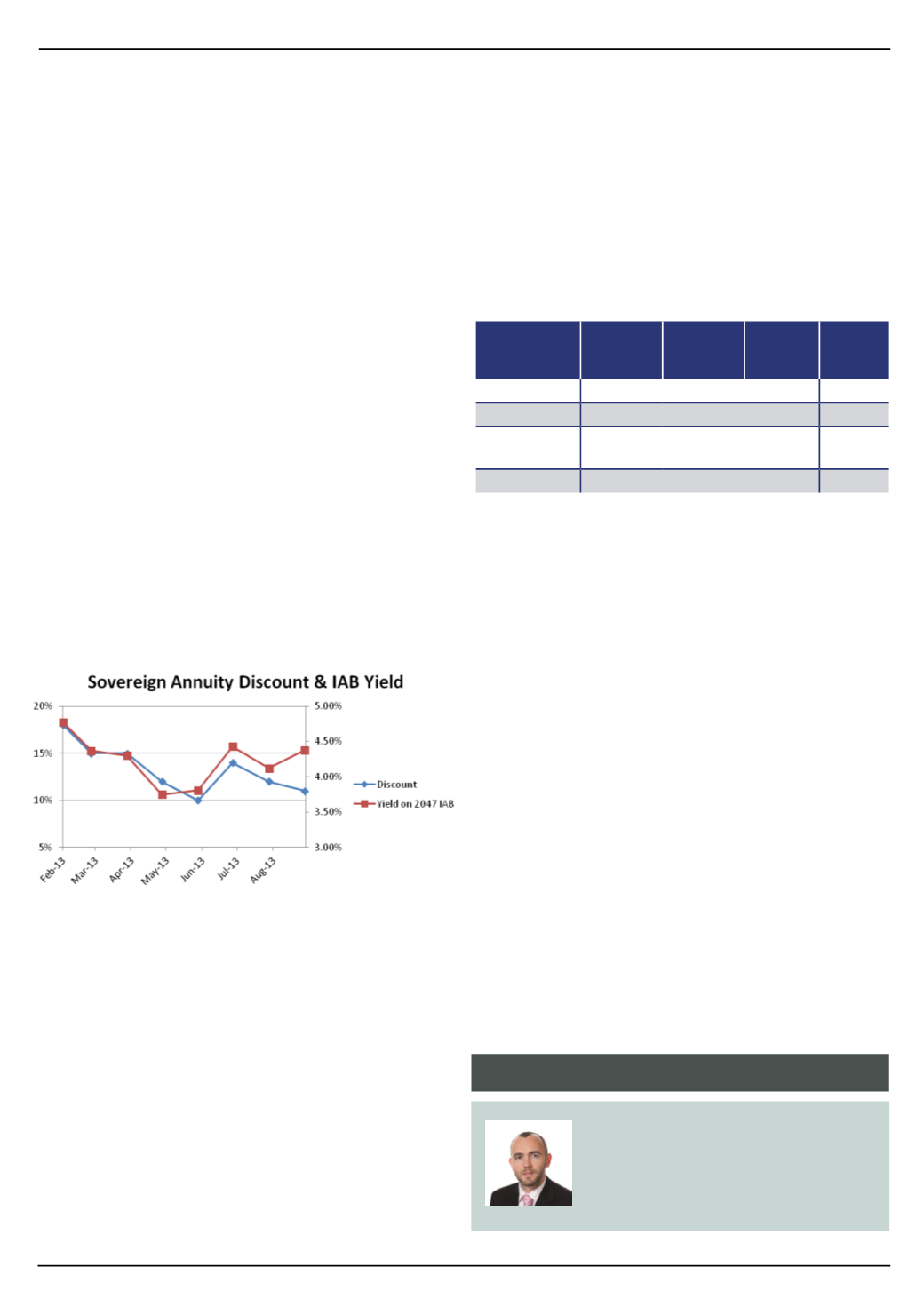

This progression over the year is illustrated in the

table below (all figures in €M’s):

Based on Irish Life data for bulk transactions only

Pensioner reaction to date has been very calm. Once

pensioners see that there pension is continuing as

before, they are generally relived. Ensuring good

communication and smooth service transition is critical

to achieving this however.

What information is required for a bulk annuity

quotation

The items below are required in order to complete

a fully guaranteed quotation. Irish Life can provide

indicative terms based on partial information at an

earlier stage in the process. We would encourage

trustees to keep their pensioner records up to date, to

give them flexibility around transaction dates, as we

have noticed this data collection process can often

take much longer than anticipated when it’s required.

• Individual pensioner data

• Scheme benefit specification

• Scheme specific mortality data for large schemes

(if available)

• Industry or occupation background

Product

Type

Q1

2013

Q2

2013

Q3

2013

Overall

Sovereign €64

€129

€144 €338

Conventional €26

€8

€59

€92

Mixed

Product

€104

€6

-

€110

Total

€194

€143

€203 €540

Article Author

Shane O’Farrell

Executive Manager-Risk and

Longevity

Irish Life Corporate Business

News