According to the Irish Association of Pension Funds (IAPF), universally acceptable and understandable quality standards are becoming increasingly important to both employers & employees alike, in light of confidence issues facing Ireland’s pension savers. On the back of this, the IAPF has just launched a new category to the Pensions Quality Standard - Merit Plus.

The IAPF believes that existing employer-sponsored Defined Contribution pension schemes covering hundreds of thousands of workers, should aspire to the base standard quality mark which was launched in 2011, with the very best schemes looking to achieve the Merit-Plus level.

According to Jerry Moriarty, CEO of the IAPF,

“Employees are forever being told that they need to have greater input into the management of their pension scheme, but most struggle to appreciate its value to them and are at a complete loss as to how evaluate its performance. These awards make that evaluation easier – pensions savers can now enquire as to whether their pension meets the PQS and if so, which level.”

How to Qualify

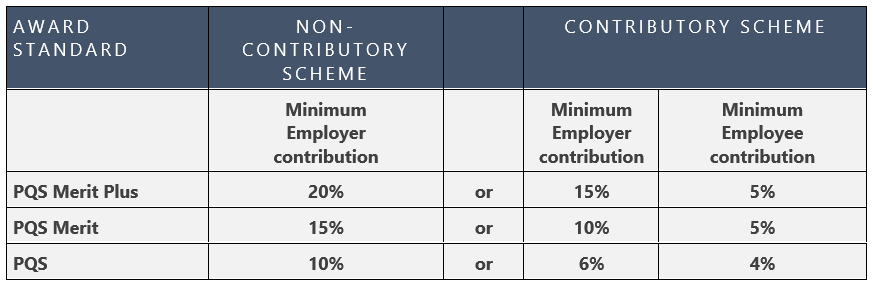

There are now 3 levels of PQS where schemes must meet governance and communication standards as well as minimum contribution requirements:

- The contribution rate required to qualify for the base Pensions Quality Standard is 10% of salary, of which the employer must pay at least 6%.

- The PQS Merit requires a total contribution rate of 15%, with at least 10% from the employer.

- Combined contributions of at least 20% with the employer paying at least 15%, are required for the new highest level – the PQS Merit Plus.

“Such is the importance that many employers place on pensions and our experience with the PQS awards to date, that we expect quite a few companies, generally with large workforces, to qualify for this new level. However, the assessment is not based on contribution rates alone as the quality of scheme governance and member communications are also assessed.”

Generous Employers

The IAPF expect a strong response to the new standard, on the basis that employers are now becoming “more generous” when it comes to contribution rates. The IAPF’s 2018 IAPF Defined Benefit Survey, which examined 65 companies comprising of over 60,000 members, with pension savings in excess of €20bn, found that of the new Defined Contribution (DC) schemes established, the maximum employer contribution rate exceeds 10% in half of the schemes, with 8% of employers contributing greater than 15% of salary. In 44% of new DC structures, the employer matches the employee’s contribution, usually up to maximum of 10%-15% of salary. In total, 86% of schemes paid more than the traditional, typical contribution rate of 5%.

Jerry went on to say,

“While the migration from the much-coveted Defined Benefit scheme over the last few years has been difficult for many employees, our survey has revealed that those employers who have replaced the DB pension structure with a DC structure are making relatively generous contributions into those schemes on behalf of employees. In addition, many employers have begun to appreciate that if they want to ensure employees can afford to retire, they have to ensure that they will be saving sufficiently throughout their careers. And, with an improving economy, having a good quality pension scheme in place can assist recruitment and retention of employees”.

Contribution Structures in Replacement DC Schemes

“Matching” is the most common employer/employee contribution structure (44%). Matching is where the employer will increase contributions to the scheme where the employee agrees to increase theirs. The employer will usually pay up to a maximum percentage of salary, typically 10% -15%, with the employee contribution usually being less than that.

Most other employers (38%) have committed to contribute a level/fixed rate contribution, typically somewhere between 5%-12%.

Note to the Editor

About the IAPF Established in 1973, the Irish Association of Pension Funds (IAPF) is a non-profit, non-commercial organisation representing pension savers whose aim is to ensure we have a secure, fair and simple system of pension provision in Ireland.

IAPF Pensions Quality Standard Award

The IAPF Pensions Quality Standard Award (PQS) is an independent accreditation that recognises quality Defined Contribution schemes based on contribution rates, governance and communications. Since its launch in 2011, the following employers’ pension schemes have been awarded the PQS, allowing them to demonstrate to their employees that they are providing them with quality pension provision.

PQS With Merit

1 The ESB DC pension scheme

2 Allianz DC scheme

3 AIB DC Scheme

4 Microsoft Ireland DC scheme

5 Roadbridge DC scheme

6 Aviva Ireland DC Scheme

7 Aughinish Alumina

8 Bausch and Lomb

9 Bank of Ireland RetireWell

10 Airbus Financial Services

11 Coillte

12 Leo Pharma

13 The Accenture DC Plan

14 Tullow Oil

15 Smurfit Kappa Ireland Defined Contribution Pension Scheme

16 Bristol Myers Squibb Ireland Defined Contribution Pension Plan

PQS

1 The Hewlett Packard Ireland DC pension plan

2 Reckitt Benckiser pension fund

3 The CHC Ireland retirement solution plan

4 Mundipharma Pharmaceuticals DC plan

5 Dell Ireland DC plan

6 Oracle DC plan

7 Horse Racing Ireland pension plan

8 Kraft foods DC pension plan

9 The AA

10 BASF

11 Citibank

12 Royal College of Surgeons DC pension plan

13 Laya Healthcare DC plan

14 Diageo

15 R& A Bailey

16 Allergan

17 Vodafone

18 The DAA

19 Goodbody

20 Kerry Group

21 SAA Defined Contribution Retirement Savings Scheme

22 Bank of America Merrill Lynch Ireland Pension Scheme

Pensions Quality Standard Award T&C’s:

- It is understood that risk costs and operating expenses are in addition to the rates noted above.

- Evidence will be sought of all applicant schemes to ensure they meet the contribution standards including those schemes which operate matching contributions. This will relate to employer and ordinary contributions only and will exclude Additional Voluntary Contributions (AVCs). Evidence is required for contributions paid in the previous three financial years.

- For schemes with matching contributions, evidence of contributions actually in payment will be considered for the purpose of the award. The award standard classification will be subject to a minimum of 50% of eligible employees paying at the upper end of scale.

- For voluntary schemes, the award is only considered against actual membership, subject to a minimum of 67% of eligible employees having joined the scheme.

- Compulsory features of contribution design (e.g. auto escalation) to be recognized at the highest point of scale.