7

Irish Pensions Magazine Spring 2015

Analysis

Advertorial

GETTING THE BALANCE RIGHT

However, we believe that there are ways to optimise

the balance of needs through a variety of overlay

and direct investment strategies. In particular,

investors could consider a Target Volatility Trigger

(TVT) framework, which seeks to provide downside

protection and yet leaves potential for upside

participation; or asset allocation strategies which

dynamically allocate according to the prevailing

market conditions, and can be a good way to help

provide downside protection and potential alpha

generation. Overlay programs using listed futures

and options to create put-spread or put-spread collar

strategies have also historically provided downside

protection.

TIMING IS CRITICAL

Aggressive de-risking can prove costly should the

markets continue to rise, and yet a ‘defensive’ stance

risks missing continued upside potential, particularly

against the backdrop of ultra-low interest rates and

QE. In light of this, we believe that implementing

downside risk protection while costs are low may

make sense. Our experience has been that it is always

better to start implementing portfolio protection

decisions when others are greedy, when there is time

to consider alternatives and also when the cost of

implementing these decisions is low. When markets

are in crisis mode — as they were in September 2008

and August 2011 — it is often, quite simply,

too late.

WAYS TO TACKLE EQUITY RISK

Target Volatility Triggers

Can provide a stable volatility level in the portfolio.

Market Regime Aware Investing

Via Dynamic Asset Allocation Funds.

Derivatives Overlays

Option-based overlays and volatility futures.

Alternative Strategies

Liquid alternatives, such as Managed Futures and

Global Macro and advanced beta equities, such as

Managed Volatility.

Fundamentals

Fundamentals may also present potential

pitfalls. From eurozone concerns to

geopolitical issues in Ukraine or the Middle

East, spats between China, Vietnam and

Japan are causing concern, and China’s

shadow banking sector also casts a pall.

But be realistic about the effect of geopolitical

risks — SSGA has researched their impact

and found that they may not have the lasting

long-term effects that many ascribe to them.

However, many investors cannot bear even

short-lived losses and avoiding or severely

limiting them makes sense in terms of time

to recovery. In any case, market-based

events can and typically do affect portfolios

deeply and broadly over the long term. The

right protection strategy should help defend

against both types of risk.

Source: Bloomberg Finance LP. As of 27 January 2015. Past performance is not

a guarantee of future results. Index returns are unmanaged and do not reflect the

deduction of any fees or expenses. Index returns reflect all items of income, gain and

loss and the reinvestment of dividends and other income.

Article Author

Niall O’Leary

Managing Director, Head of

EMEA Portfolio Strategists Group

State Street Global Advisors

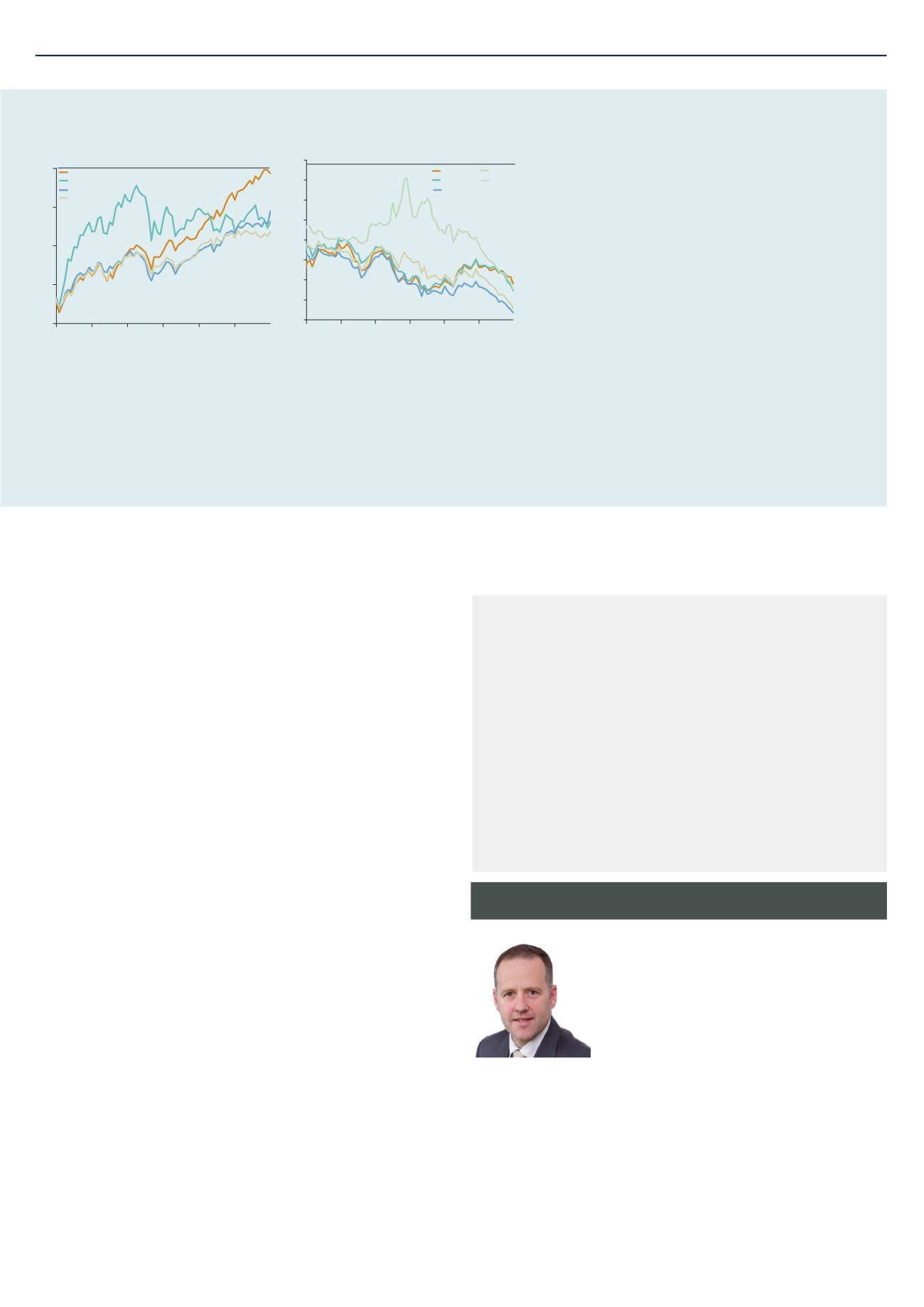

70

110

150

190

230

2009 2010 2011 2012 2013 2014

Rebased to 100

S&P500 Index

MSCIEmerging Markets Index

STOXXEur 600Price Index EUR

FTSEAll-Share Index

Equity Indices at All-Time Highs

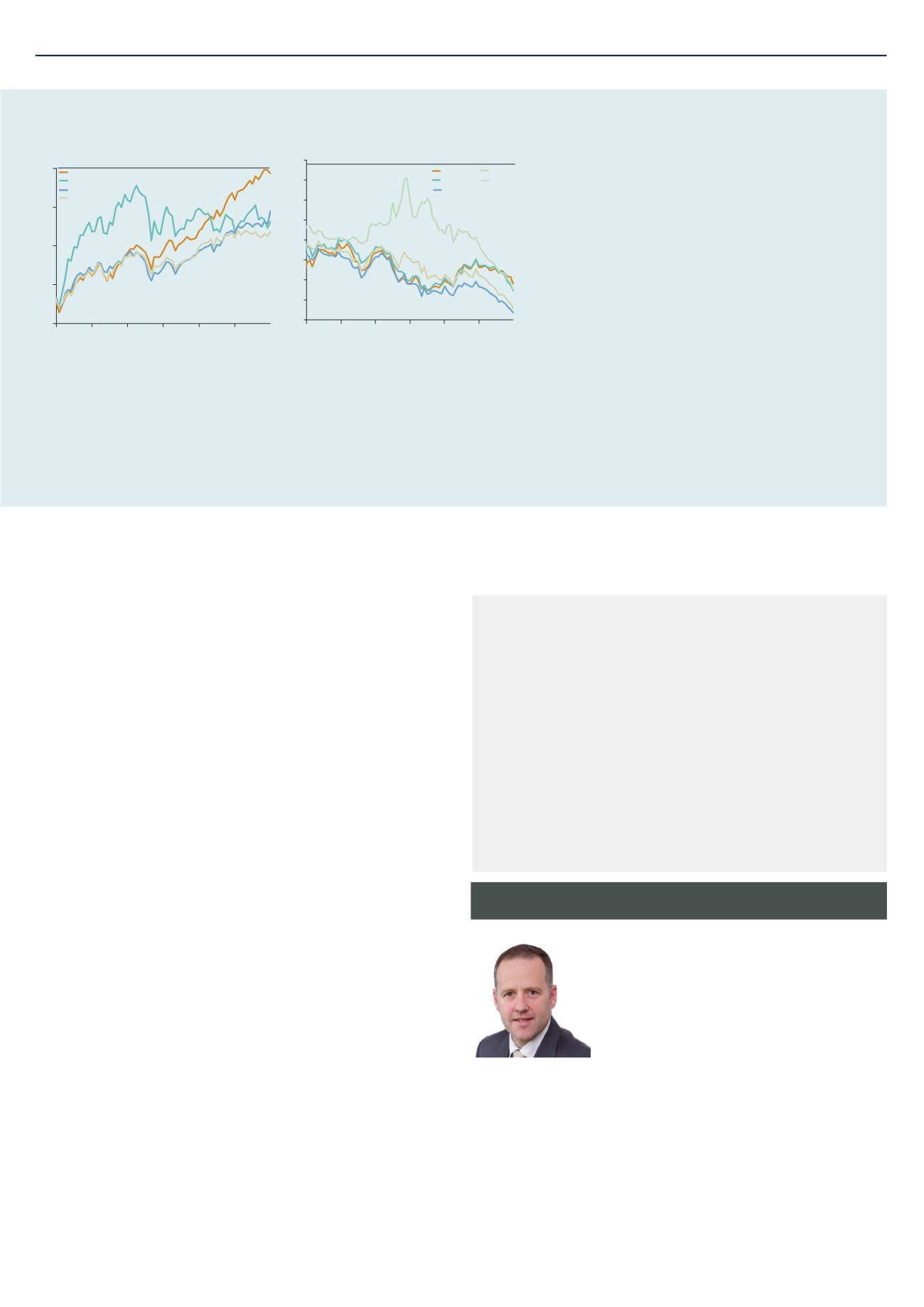

0

1

2

3

4

5

6

7

8

2009 2010 2011 2012 2013 2014

Bond Yields at All-Time Lows

Percent

US

UK

Germany

France

Italy

State Street Global Advisors Ireland Limited is regulated by the Central Bank of Ireland. Incorporated and registered in Ireland at Two Park Place, Upper

Hatch Street, Dublin 2. Registered number 145221. Member of the Irish Association of Investment Managers. Investing involves risk including the risk of

loss of principal. Past performance is not guarantee of future results. The whole or any part of this work may not be reproduced, copied or transmitted or

any of its contents disclosed to third parties without SSGA’s express written consent. The information provided does not constitute investment advice as

such term is defined under the Markets in Financial Instruments Directive (2004/39/EC) and it should not be relied on as such. It should not be considered

a solicitation to buy or an offer to sell any investment. It does not take into account any investor’s or potential investor’s particular investment objectives,

strategies, tax status, risk appetite or investment horizon. If you require investment advice you should consult your tax and financial or other professional

advisor. The views expressed in this material are the views of Niall O’Leary through the period ended 23 January 2015 and are subject to change based

on market and other conditions. This document contains certain statements that may be deemed forward-looking statements. Please note that any such

statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. © 2015 State

Street Corporation – All Rights Reserved